Disclaimer: I own the Toronto-listed company ticker – TSE:EIF.

I don’t own a whole lot of “smaller” local companies anymore – in particular, outside of Scandinavia. My focus has shifted over the past few years to encompass the larger international companies. There are a few exceptions to this rule, but I find that none of them are as poignant at this time as looking at Exchange Income Corporation or EIF (EIFZF). The company trades on the Toronto stock market under the symbol EIF (which is also how I own it, not the ADR), and I’ve written about it quite extensively before.

There are several reasons why an update and a new article are warranted – which you’ll see as I go on here.

Exchange Income Corporation – How has the company been doing?

When COVID-19 began, I looked over my portfolio and realized that a small holding was likely to be affected. I didn’t own any airlines and I quickly abandoned any plans of buying even those considered higher quality. My modest position in Exchange Income Corporation, however, was one I kept.

Some reasons for this.

First, Exchange Income Corporation has some extremely resilient segments which aside from passenger transportation and airline services, includes logistical and medivac, charter, helicopter services, and so forth. For some of these services, Exchange Income Corporation is the sole contract holder in the entire area, and even with COVID-19 ravaging the world, I knew that remote areas would still need service. The impact upon these would be felt, but they wouldn’t go to zero.

Second, Exchange Income Corporation is only a partial airline services or carrier company at this point. Through Ben Machine products, Quest Windows, Westower communications, and other subsidiaries/companies, the company is now diversified into industrial production – which would see no more drop than other industrials.

Third, despite being a small company, Exchange Income Corporation has always shown financial acumen bigger than its breeches and has an excellent history of maintaining and increasing operations, profits and dividends not only during good times but bad as well. The company’s payout ratio was low, and I could even handle a small cut to the dividend. While this time could be different, I chose not to act due to my faith in management here.

I knew that there were to be some negative effects, especially in Regional One which distributes aftermarket parts and regional aircraft. However, to sum it up, I believed after careful analysis of the company’s historical results and current finances and after having done several deep-dives on the company, that they would be fine even during one of the worst air service crises in history.

(Source: Annual Reports)

I don’t see it as exaggeration to say that my forecast here has been confirmed.

2Q20 results for Exchange Income Corporation were, as things go, excellent.

With a majority of company revenues still coming from aerospace and aviation, analysts and investors may expect things to be as bad as some domestic or international carriers. This is not the case, and I’m going to emphasize the CEO’s words here, that this comparison is actually flawed.

With the company operating in medevac, freight, trading, maritime surveillance, parts and leasing, passenger business may be a part of Exchange Income Corporation’s business – but it’s just that. A part.

Proof?

- The company’s 2Q20 resulted in an EBITDA drop of 29% YoY to $62M – but still very much positive.

- Adjusted net earnings of $0.16/share, which while down, are also positive, same with unadjusted earnings.

- The company has reduced net debt by $40M due to positive FX.

- The company paid down debt, paid the dividend, and funded CapEx – all without accessing debt or the capital market.

- The company’s monthly $0.19 dividend has been maintained and is funded by a 78% 2Q20 FCF payout ratio – far lower than 100%, and only up some from the pre-pandemic 55-59%.

- The company closed a deal, acquiring Window Installation Services, a company that installs Exchange Income Corporation’s subsidiary (Quest Windows) products, a similar purchase to AWI last quarter. These M&As are highly accretive to shareholders in the long term.

I want to speak on the individual segments a bit – because I really do want to highlight how an airline/aviation company with segments without passenger exposure has fared.

<img src="https://dashbrokerreview.com/wp-content/uploads/2020/09/saupload_531d9f34549afbdebc58bea011122e01.jpeg" alt="Does Exchange Income Corporation (TSE:EIF) Create Value For …” data-width=”1194″ data-height=”432″ data-og-image-twitter_small_card=”true” data-og-image-twitter_large_card=”true” data-og-image-twitter_image_post=”true” data-og-image-msn=”true” data-og-image-facebook=”true” data-og-image-google_news=”true” data-og-image-google_plus=”true” data-og-image-linkdin=”true” loading=”lazy”>

(Source: Yahoo)

The company’s Medevac businesses were excellent, in that over ensuing months, service demand has recovered to pre-pandemic levels. Airplanes are flying, as it were.

The company’s maritime surveillance contracts were actually unaffected by the pandemic, with short-term deployments with new customers having been scheduled for 3Q20 and 4Q20.

Company Logistics/Freight businesses were also fairly unaffected by the pandemic’s impacts. Exchange Income Corporation saw, in fact, an increase in demand due to stay-at-home orders. While freight suffers from lower margins than passengers, these airlines were never grounded and passenger numbers are recovering.

The company’s manufacturing businesses showed surprising resilience and demand spikes during the pandemic. With COVID-19 hitting different parts of the north-American continent at different times, impacts on job sites were different – opening and closing at various times. The company does expect some continued inefficiency from these segments, but manufacturing order books remain well-filled, and the company’s short to medium-term forecast is bullish.

In the negative, we have the performance of Regional One, as one might expect from this subsidiary due to its aftermarket part and leasing exposure. While the company has seen an increase in demand here during late months (July/August), the company doesn’t expect significant improvement until 2021 when volumes normalize.

(Source: The Market Herald)

So – let’s wrap a bit here. The company, led by Mike Pyle, was able to maintain positives, fund CapEx, dividends, and reduce the net debt during the most challenging quarter ever faced by Exchange Income Corporation. This in itself should be indicative of the company’s quality, and a testament to why I own the stock despite my extremely conservative desired focus.

Company liquidity is excellent for a company this size. With access to a $1.3B facility (of which $802 million is used, down $90M sequentially) and another $300M in an accordion, the company has excellent access to cash – though the fact that operations gave positive cash flows during this quarter should indicate its need. The company currently has no long-term debt coming due until December of 2022.

The company has also spoken and negotiated with its syndicate of lenders, who have unanimously accepted to increase the acceptable leverage ratio within current covenants until September 2021, from a 4X to a 5X. This increase is explained as the desired potential for flexibility in terms of M&As, not as a need to draw it at this time. The fact that the capital markets accept this during this time, however, should indicate the company’s quality as well. The current ratio within both the old and this new covenant is 2.28X, up from 2.1X in FY19.

The biggest drag in terms of concrete results for 2Q20 was, unsurprisingly, the company’s Aerospace & Aviation segment, which dropped 41% YoY. Passenger volume was down 90% – but cargo volumes remained and remain as strong as things normalize.

All of this occurred, while the company didn’t actually participate in the payroll protection program within the US. It did receive support from the government of the Nunavut province, which provided a revenue guarantee. It’s also used support from the CEWS program in Canada to protect vital expertise and not having to let go of employees.

In terms of recovery, the concrete visibility for Exchange Income is low. Schedule passengers are currently 40-60% of normal, and restrictions are still in place. The company does expect that volumes will recover quickly once these are lifted, however, and current volumes are already a 90% bounce-back from April 2020 levels. Overall, the company sees a gradual recovery for most of the company as a whole, with Regional One’s recovery dragging things down a bit. The positive part here is that the company’s usually high CapEx is dictated by its airline operations – and as these declines, so does the associated costs – and it won’t go back up until flight hours start increasing again.

The company has also, as of 2Q20, finalized contracts with the Netherland coast guard concerning 2 Dash-8 aircraft.

(Source: Wikimedia)

(Source: Wikimedia)

These are expected to be operational within 17 months.

So, all in all, 2Q20 was a positive one for the company. This is especially true in the larger context of the aviation industry, which has suffered devastating losses during the quarter – not so for Exchange Income Corporation.

Let’s look at valuation.

Exchange Income Corporation – What is the valuation?

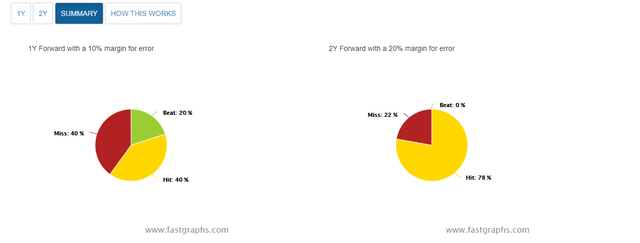

There are a few ways we can look at how EIF is valued, but common among them is a fairly large lack of precision in short-term analyst estimates. Looking at a 1-year forecast, analysts are unable to really forecast company earnings accurately, which means that these forecasts should be considered with this in mind. What I can say is that in the longer term, these forecasts come to a level we can start to consider indicative – if not really “accurate,” as such.

(Source: F.A.S.T. Graphs)

This means that the company’s long-term direction is easier and more logical to forecast, but short-term trends are more volatile.

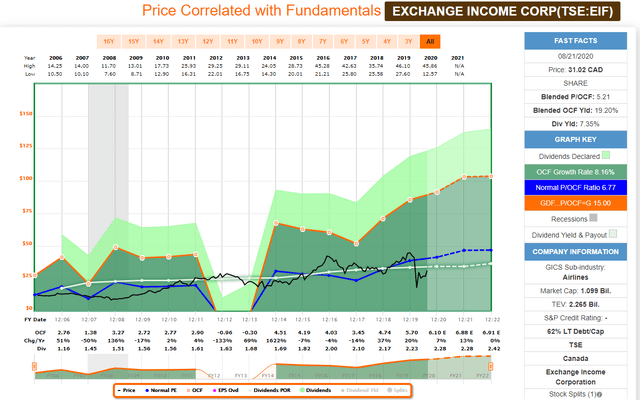

In terms of how to value EIF, I see the most logic in viewing its valuation in terms of its operating cash flow multiple.

(Source: F.A.S.T. Graphs)

EIF trends toward a long-term 6-7X OCF multiple, which makes the current multiple of 5.21X undervalued when looking at the company as such. Given the company’s recent M&As and new investments, it’s likely that the forecasted growth in OCF will materialize – based on historical trends during similar times. The massive unknown here is how quickly things in the company’s legacy airline/transportation segments will normalize, as these are some of the primary revenue/OCF drivers.

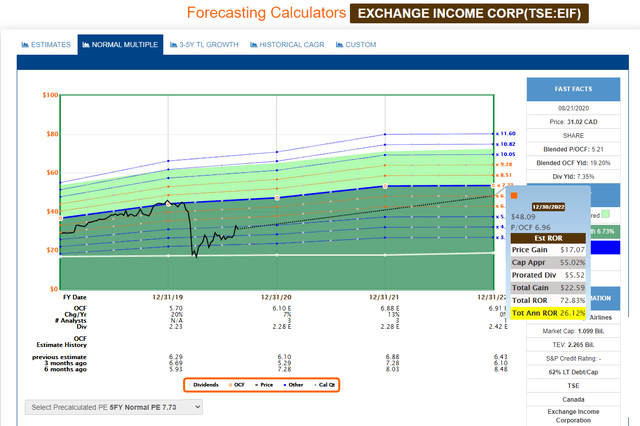

(Source: F.A.S.T. Graphs)

If you accept the premise that the company will eventually return to normal operations – a likely scenario given the company’s operational and contract structure – then the question only becomes “when.” At such a time, if it happens within the next 3 years, the company would return over 26% per year if returning to a normal 6-7X OCF multiple and if the growth drivers materialize to some degree. Even trading at current multiples, however, your returns would still be close to 15% per year.

The company’s earnings multiple paints a similar picture, but one fraught with more volatility in the forecasted earnings cadence – things are expected to really drop down, only to massively bounce in 2021E.

(Source: F.A.S.T. Graphs)

In one of my previous articles, I valued EIF based on its EV/EBITDA multiple to give a target multiple of around 7X. The problem is that this can become somewhat unclear during a time such as this when EBITDA is depressed without necessarily being indicative of any truly long-term problem. During the worst of the crisis, the company dropped to 5.85X EV/EBITDA – which was undervalued to the extreme, but it has since recovered to somewhat over 7.5X. However, part of this is due to the poor current EBITDA, impacted by COVID-19. A look at cash flow multiples or tangibles gives us a picture which, as I see it, more correctly shows the company’s valuation in the longer term and where forecasts include the effects both of the new M&As and a return to normal valuation.

It is because of this that I choose to look at the company’s OCF multiple as more indicative in the long term at this time. At a fair-value historical multiple in terms of operating cash flow, EIF trades similar to my discussed EV/EBITDA 7X multiple – namely at a price target of around ~$45/share for a 7.7X OCF multiple. Long term, and at a 2022E OCF increase from 6.10/share during 2020E (the current forecast) to $6.91/share in 2022 – which I consider to be valid given the company’s recovery and new M&As, this gives us a long-term price target of ~$52/share at a 7.5X operating cash flow multiple – but let’s make that $48/share, to represent the lower end of the historical 7X OCF multiple. Even the current analyst consensus at today’s share price, however, reaches a ~$39/share target, averaging 9 analysts, indicating an OCF multiple of around 6.5X during times when the company is still heavily impacted (Source: S&P Global Infront). Based on that 2020 price target, the upside in Exchange Income Corporation could still be considered to be 22%. When considering the 2022E results, we would have an upside of over twice that – 50%.

In either of these scenarios, I view Exchange Income Corporation as an unequivocal “Buy.”

Exchange Income Corporation – Bulls and Bears

Bulls for the company such as myself point to the company’s resilient fundamentals which have delivered some of the most impressive aerospace earnings and results during COVID-19 that can be found. Funding dividends, CapEx, investments, and lowering debt during COVID-19 while maintaining a sub-80% dividend payout ratio is nothing short of stellar and should be considered indicative of the future of the company.

While there is a risk of an over-extending towards too many different industries and segments, Exchange Income Corporation has thus far shown itself to manage acquisitions well, both its airline/aerospace and its manufacturing subsidiaries.

Bulls would argue that aside from results, management has proven its capabilities during this crisis and should be considered excellent as well. While the company lacks some of the safety of a truly “massive” corporation in the hundreds of billions, it has the agility of a smaller business combined with a not-insignificant degree of robustness from its exclusive contracts and recession-resistant businesses.

The dividend growth history is excellent. Company history is excellent – and the price you’re paying for this company at this time is, at best, lower than in years, and at best (if you look strictly at multiples such as EBITDA), around “fair value,” despite a recently-affirmed 7.15% yield which is paid out on a monthly basis.

Bears would take a different tact. The company’s size is too small, the company contracts, while exclusive in part, are also limited and may change going forward. It’s a too uncertain prospect to base a business upon, and while the company has done initially well in its manufacturing operations, these ambitions are far too young to be viewed with any sort of permanence or true indication of quality as of yet.

Exchange Income Corporation may be a capable company in terms of airlines and carrier services, but in all its other ambitions, it should be viewed as untested. The combination of this with its size and the risk associated with this is too high in comparison to the reward you’re getting, even if that dividend has recently been affirmed.

I would characterize a legitimate bear case against the company as based more on EIF’s size and operational scale more than on the company itself – the company itself has posted “too good” results to be the victim of all that much fundamental doubt, as I see it. The contextual risk compared to larger, safer companies, however – that’s a part of the bearish thesis I can actually get behind and, at least in part, agree with.

Whether it makes the company uninvestable for a conservative dividend investor, that’s a different thing and one investors would have to decide themselves. Bears would say yes.

I would say no.

Thesis

Investing in smaller-scale companies always comes with a significant amount of risk and uncertainty. The businesses are far more volatile and trade at completely different multiple patterns than we may be used to from investments in mega-cap corporations.

I own a few companies in Scandinavia that fit the bills as “small” companies – one of my financial/bank holdings has a market cap of under $900M, but I’m always more comfortable and confident investing in companies I have in my backyard.

EIF certainly isn’t in my backyard – it’s across the pond, thousands of kilometers away. Rules are different. Over the course of the past 2 years, I’ve carved away most of my smaller holdings in favor of investing at lower-yield but far safer holdings with excellent growth prospects. The ultimate ambition of my portfolio as I currently see it is about a $1M portfolio yielding between 4-5%. At this point it would be able to fund my life based only on dividends wherever I would choose to live, provided I also still do what I consider “fun” (as in, work). As such, every investment until that goal is ultimately reached, is with that goal in mind.

Exchange Income Corporation is the only holding I would consider “small” left, in my entire NA portfolio. I view the reasons for this as very good. The company has excelled fundamentally during the time I’ve owned it and continually proven able to handle changing market environments. The leadership navigates with skill, and with these latest trends during the worst pandemic in 100 years, this company has proven itself worth the spot in my conservative investor’s portfolio.

This is a company where you invest being aware of the company’s size and operational risks, if the company’s exclusive deals somehow go sour in the coming years, and a company that needs an eye kept on it, more than companies like Coca-Cola (KO). But it’s also a company that yields over 7% which has recently been affirmed in one of the worst market climates on record, at a sub-80% payout ratio. It’s a company that I consider safe enough to invest in, despite its size, and it’s a company that’s looking down the barrel at a 20-50% undervaluation to a fair OCF multiple, depending on what time period you’re looking at.

I have 0.67% of my portfolio in EIF, which is sizeable for me given my portfolio size. I am still willing to expand this further, though with care.

I suggest you look into the company and see what you think.

Thank you for reading.

Stance

At 20-50% undervaluation, depending on your time frame, Exchange Income Corporation is a “Buy” with a bullish rating.

Disclosure: I am/we are long EIFZF, KO. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: While this article may sound like financial advice, please observe that the author is not a CFA or in any way licensed to give financial advice. It may be structured as such, but it is not financial advice. Investors are required and expected to do their own due diligence and research prior to any investment.

I own the European/Scandinavian tickers (not the ADRs) of all European/Scandinavian companies listed in my articles.